Tax Exempts

- First, check to see if sales taxes may apply to your order. We collect sales taxes in the following 22 states and territories: California, District of Columbia, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, New Jersey, North Carolina, Ohio, Oklahoma, Pennsylvania, Puerto Rico, Tennessee, Utah, Washington, and West Virginia. If you place an order that will ship to a state other than these states, then the sales taxes will be removed from the order when the shipping address is entered.

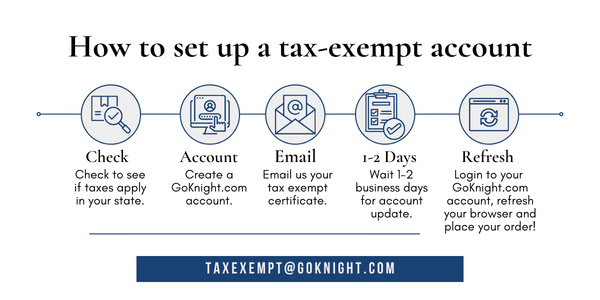

- Please sign up for a GoKnight customer account.

- Please email your Sales Tax Exempt Certificate to taxexempt@goknight.com and let us know the email address associated to your GoKnight account discussed in step #2.

- It typically takes 1-2 business days to validate your certificate and set up your tax exempt account. We will notify you when your tax exempt account is ready to use.

- Before you add items into the cart, log into your GoKnight customer account. This will pick up your tax exempt status.

WE OFFER NON-PROFITS CUSTOM PRICING. If you are looking for our most favorable, customized pricing - then please Live Chat or call us at 1-866-457-5937 for your custom quote. We can provide the best pricing with larger, volume purchases.

WE OFFER NON-PROFITS CUSTOM PRICING. If you are looking for our most favorable, customized pricing - then please Live Chat or call us at 1-866-457-5937 for your custom quote. We can provide the best pricing with larger, volume purchases.

WE ACCEPT PURCHASE ORDERS. We typically request that your first order is placed via credit card or a traditional payment method. At that time we can gather all necessary information to set you up in our payment systems to take subsequent orders via PO. Your account must pass through the credit check process before we can accept order via PO. Please contact us at 866-457-5937 or info@goknight.com to set up your customer account for payment via PO. You can submit your PO to PO@goknight.com.